You found your perfect household: maybe it’s because most readily useful area, has actually a roomy cooking area, a health spa-such as toilet, and you may a vast turf which have flawless land. However, you to definitely finest matches may also include a substantial rate tag.

When the time comes to acquire your mortgage, a lender you are going to tell you that need a beneficial jumbo loan. Exactly what really does that actually mean?

Within publication, we are going to answer the question, What’s an excellent jumbo home loan? In addition, we will walk-through jumbo mortgage rates, exactly how good jumbo loan performs, the difference ranging from jumbo and you may conforming finance and more.

What exactly is an excellent Jumbo Financial?

Called good jumbo financing, good jumbo mortgage is utilized if loan amount is higher than old-fashioned compliant loan constraints place of the Government Property Financing Department (FHFA). Jumbo financing can be used to money many house brands including number one homes, trips property and you may financial support features.

Jumbo Funds against. Conforming Funds

A normal loan is a type of financing that’s not recognized or insured by a national agency (FHA, USDA and Va). There have been two types of conventional financing brands: conforming and you will non-compliant.

A compliant mortgage doesn’t discuss maximum government limits implemented by the FHFA. It realize guidelines founded because of the Fannie mae and you will Freddie Mac, a few regulators-paid people. Federal national mortgage association and you may Freddie Mac computer buy conforming mortgage loans to provide bank currency very lenders can be situation even more mortgage loans.

Brand new 2022 limit compliant financing restriction (CLL) was $647,200 for the majority counties of your own You.S. Any home loan matter over one restrict needs you to get a beneficial jumbo mortgage. Inside the high-pricing areas, the 2022 CLL is $970,800. This type of loan roof numbers transform from year to year to echo home rate fashion in the nation.

At exactly the same time, non-conforming funds as well as jumbo fund commonly purchased from the Federal national mortgage association and Freddie Mac computer.

Lenders always continue jumbo mortgages, definition they don’t really promote them to Federal national mortgage association otherwise Freddie Mac computer. This type of loans are not always guaranteed or insured, leading them to riskier, even in the event per bank possesses its own criteria to own jumbo financing.

Jumbo Loan Rates

It might seem it is possible to shell out a high rate of interest to own an excellent jumbo mortgage, yet not constantly. Jumbo financial cost might actually feel lower or very aggressive compared so you’re able to old-fashioned field cost.

How come an effective Jumbo Loan Work?

Does a jumbo mortgage really works including a normal financing? The solution is actually yes – to help you a spot. You should see more strict conditions to have property type, down payment, credit score and you may loans-to-money proportion.

You can choose from a fixed-speed loan or a changeable-speed mortgage. While the names mean, the rate stays a comparable during the whole financing name with a predetermined-price loan and you will changes inside financing label that have a varying-rates financial.

- Possessions brands: Since there commonly any regulators requirements guiding him or her, ??regardless of what kind of property you get having a good jumbo loan so long as you meet the lender’s requirements. Thus if we want to purchase an investment property otherwise a great first household, you need to use an effective jumbo financing to accomplish this.

- Down-payment: You are able to usually need certainly to lay out increased down payment having good jumbo mortgage. Your own financial ple, however, standards may differ of the bank. Down-payment conditions are based on house type, amount borrowed and credit history.

- Credit score: Your FICO credit rating, and therefore range away from 3 hundred to help you 850, are a around three-finger matter that shows how good you have to pay straight back debt. You generally need to have the absolute minimum credit history of 620 inside the acquisition to obtain a traditional loan. Yet not, your financial will likely require you to features increased borrowing from the bank rating getting a good jumbo mortgage as compared to a normal financial.

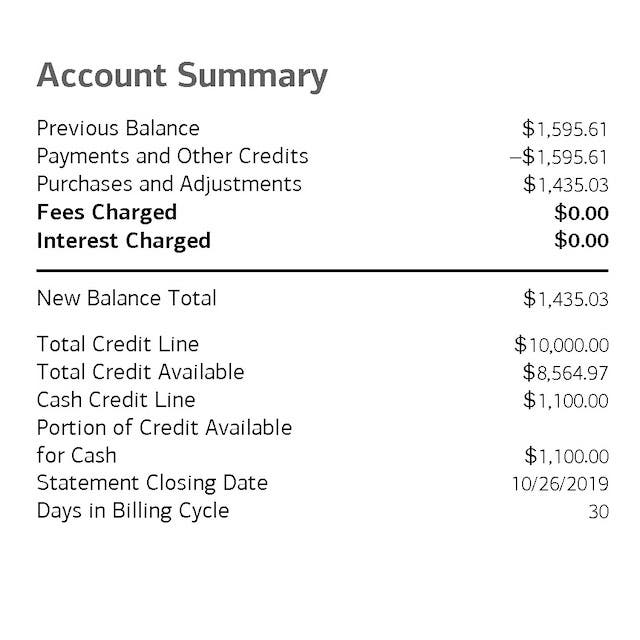

- Debt-to-income ratio (DTI): Your DTI ‘s the portion of your debt financial obligation you invest as compared to your own month-to-month revenues. You might calculate your DTI on your own because of the breaking up people necessary month-to-month lowest payments by your month-to-month revenues.

Great things about Jumbo Finance

Why you should rating an effective jumbo mortgage, anyway? You might have currently realized one of the leading masters: jumbo fund enable you to acquire more this new constraints set because of the Fannie and you can Freddie. And if you are shopping for to shop for a property that needs a beneficial mortgage over the antique loan limits for your city, you’ve got an option option.

- The opportunity of aggressive interest rates

- The ability to use a full amount of money from mortgage unlike cracking it towards the two some other money

- A great deal more flexibility than antique loans which includes loan providers providing significantly more personalized home loan choices

Jumbo money can a more full economic unit since the it allow you to favor a home loan that works ideal for your. They may even be a key element of your general financing strategy, especially if you decide to buy a home otherwise need to invest in in the place of tie-up a ton of money in real estate.

Unique Conditions to own Jumbo Mortgage loans

Right now, you actually realize that need good credit, consistent earnings and you can an effective manage on your financial obligation managed to obtain a great jumbo mortgage. Let’s examine more jumbo financial standards less than.

- Lenders might need cash reserves: Jumbo lenders may require that convey more loans Hurtsboro AL cash in the financial institution to make certain you’re not in danger of defaulting on the your loan. You may need to demonstrate that you features 1 year value of mortgage repayments on hand before you could be eligible for a great jumbo home loan.

- Closing costs try highest: Jumbo mortgages will often have highest settlement costs than conventional mortgages because the of time it needs to assess the extra qualifications that incorporate a beneficial jumbo financial. Jumbo loans as well as generally speaking want high down money and you can taxes since really.

Morty helps you determine whether a beneficial jumbo mortgage is the right financial method of for your needs. Regarding monthly obligations to help you refinancing your mortgage to financial insurance, brand new Morty writings talks about it all. And when you’re ready to begin, you should check the latest financial rates on Morty.