Although not, having fun with credit cards can be high priced because you will getting using fee for every single day your bring that harmony

- Do not romantic old borrowing otherwise credit cards (particularly the of these you may have met with the longest), given that doing this wil dramatically reduce the borrowing limits which in turn is also negatively effect your rating. Section of your credit rating will be your use proportion, the level of borrowing from the bank available for you compared to the the amount of obligations you are carrying. When you yourself have a maximum of SAR 75,100000 for the credit restrictions available all over all of your cards and youre carrying SAR twenty two,500 with debt, their use ratio was 30%. For people who intimate one to cards which have a good SAR twenty-five,100 limitation upcoming, as well as a-sudden, their application proportion jumps to help you forty five%. This may impression your rating.

- Make an effort to establish a variety of credit not just borrowing and you may charge cards, however, tools, car loans and you can mortgages so long as you can afford him or her.

- Dont apply for credit it’s not necessary.

You might see SIMAH contact info in the An occasional overview of their credit bureau statement features you advised about your agency get and its own development, most of the credit business which you have together with its percentage standing and any negative suggestions said into borrowing from the bank agency. SIMAH including shows the key points that were instrumental inside coming in at your score. Considering your score SIMAH categorizes on among five categories between extremely high exposure so you can very low exposure. Which rating and resulting class possess an impact on your when you submit an application for credit otherwise when loan providers review any existing borrowing business that they’ll have supplied your. A routine article on your own bureau statement along with protects you against id theft that may exists when the an enthusiastic not authorized people uses your label so you’re able to fraudulently see borrowing from the bank making use of your term away from a lender. In such instances you ought to get in touch with SIMAH instantaneously to own which issue treated

A charge card enables you to pay-off what you owe more time

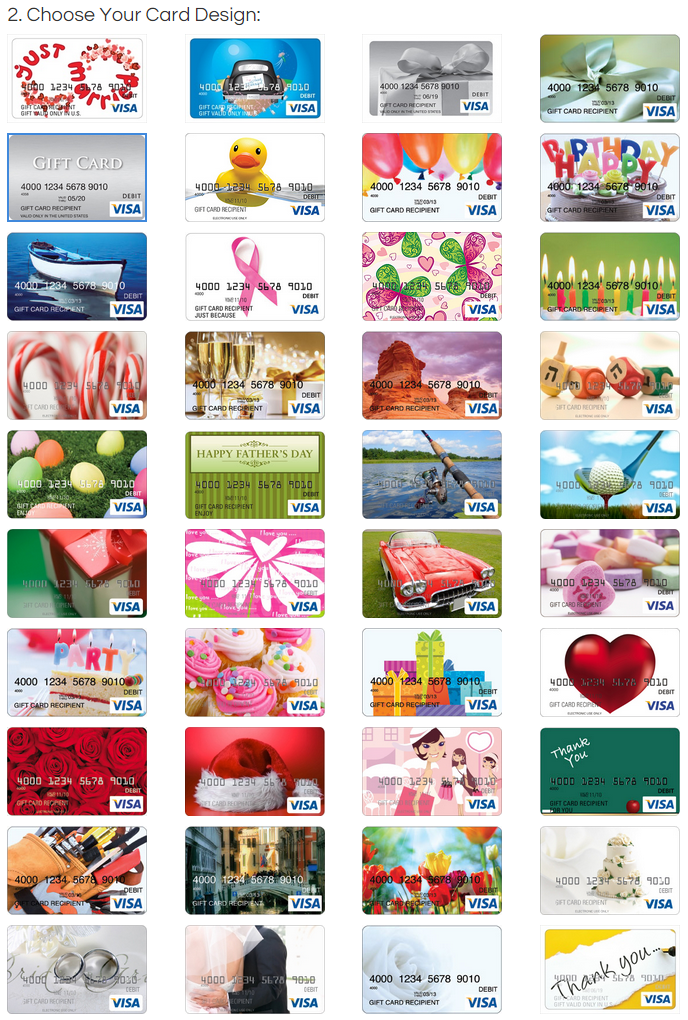

Exactly how many credit otherwise credit cards do i need to features? That’s installment loans for bad credit in Houston a bit of your own decision, however, fundamentally you should have no less than a couple. not, you will want to acknowledge the difference between a credit and you may a charge card. A charge card cannot will let you revolve a balance. It needs to be repaid completely in approximately 25 months on big date their statement are made. For each and every month that you don’t pay what you owe in full, you will be charged payment. Now, as for these notes, the first would be a credit card having a minimal speed out of percentage in case you need buy something which you pays off throughout the years. The following would be a card otherwise charge card that delivers your some thing straight back for making use of they an incentive such as for instance frequent flyer kilometers or cashback. You ought to afford the benefits credit off each month and also for one to reason, would be to consolidate as much of your own spending on that it card since you’ll be able to to increase brand new perks you can use secure. If you have a business, you will need a different card to possess accounting aim.

When should i have fun with a cards or credit card in the place of a great debit credit? Whether or not you can utilize their borrowing or debit credit utilizes a few products. Contemplate, a great debit cards deducts funds from your money immediately if you find yourself credit cards need to be reduced in full within throughout the twenty five weeks about big date your declaration are generated. Only the bank card provides you with the choice to settle your debts through the years. This is certainly of good use when you’re these are a huge get you are unable to afford to fund in one single month. Such as, when you yourself have an outstanding balance from SAR seven,one hundred thousand and also you want to pay only the minimum due, it will take 78 weeks to repay the balance completely. The complete commission, in such a case, could well be SAR 5,896. Whenever you can pay the balance from fool around with any cards provides you with the greatest benefits and also the very when it comes to consumer coverage keeps. If you can’t pay the harmony off consider whether or not you ought to make purchase today anyway. In case the response is sure, use the bank card on your wallet that has the lowest interest otherwise envision making an application for that loan. Ultimately, whenever you can afford the balance of you have not utilized your credit cards inside a while, contemplate using him or her to possess a little purchase once per month and you may investing one equilibrium out-of. This will help you make a credit score and continue maintaining the new one to you really have in good shape.