Federal Homes Management (FHA) fund help you obvious a few of the difficulties in the process to purchasing property, with additional relaxed certification than many other loans.

You’ll need a good otherwise better credit score and you can a financial obligation-to-income 1 ratio (DTI) out-of 55% or lower. FHA money appear in fifteen- and 29-year conditions, and personal financial insurance rates might be required for the life span out of the borrowed funds dependent on their down payment fee.

Take a look at Colorado Homes and you will Monetary Authority’s system for much more details about providing financial assistance to make the down payment.

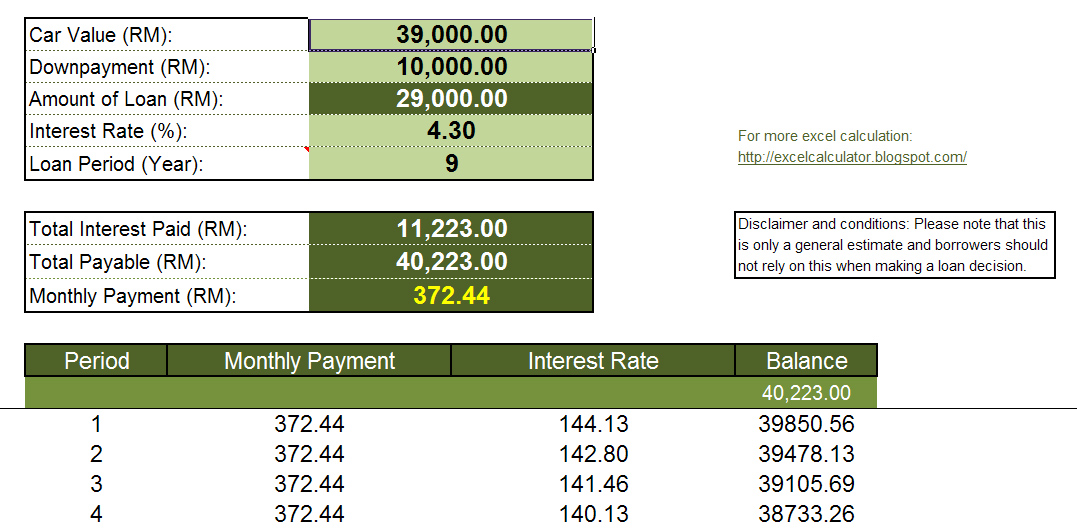

Prepared to know the way much home you really can afford? Simply enter some basic information toward home loan calculator below in order to imagine the total monthly payment, plus dominant and you can focus, month-to-month property taxes, charge and you can insurance rates.

Comes from which computation is hypothetical and tend to be to possess illustrative purposes simply. Hand calculators are going to be put as a self-let equipment just and don’t check out the effect out of fees that can use. Show might not be applicable to your individual disease and you can perform perhaps not form a deal. I remind you to seek advice and suggestions regarding a qualified professional of all the private finance factors. Real terminology can differ.

If you would like make sure that a keen FHA financial are your best option to you personally, get in touch with the mortgage professionals. These include prepared to reply to your concerns, and also have the regional experience so you’re able to highly recommend the best financing to have yours disease.

Make the most of all of our 100 % free equipment, useful stuff and a lot more. You’ll be able to stress faster getting the learn-how you need with certainty reach your goal of homeownership.

Focusing on how far you will need having a deposit is actually an important part of the house-to invest in processes. Your downpayment amount not only will make it easier to determine if you have got adequate money spared to buy a house but can and additionally affect the monthly obligations going forward. Check this out for more information on the down payment standards for different lenders.

Little could be more enjoyable than just buying your basic home! Just after years of saving and you may leasing, it is in the long run time to function as master of your website name. However, to buy a home can be even more complicated than your might comprehend. The price of the house is one little bit of the new picture since you navigate all this-too-crucial pick. Regarding finding a mortgage in order to cost management having unexpected costs, we will take you step-by-step through each step of processes.

How to get Pre-Accepted to possess a mortgage

Do you want to accommodate check, but they are thinking “Exactly how much financial should i pay for?” Bringing pre-recognized getting a home loan can display manufacturers your an effective severe candidate and give you a leg upon almost every Wisconsin installment loans interest other people who act rashly when you go to open properties without even understanding the finances. Within field, in which providers are receiving of numerous offers and dollars has the benefit of, good pre-recognition can help you be noticed as a buyer. If you have a documented pre-recognition, the vendor knows you’ll be able to find the financial support you are providing with the house and will also be capable close quicker and you will easily.

Adjustable-speed and you will repaired-rate mortgages

The rate on the financial usually be repaired otherwise changeable based on what kind of financial you choose. A predetermined-speed financial means the rate will stay a comparable more the entire lifetime of the borrowed funds. You will need to spend the money for exact same count monthly until the balance is actually repaid completely. Having a varying-rate home loan, the interest rate are different within normal times, which means that your payment will vary. One another types of home loans allows you to safer a piece regarding property, but they have various other fine print that will affect your bank account. Consider this to learn more about the difference between fixed-price and you will variable-rate mortgage loans.