Individual Conformity Mentality: 3rd One-fourth 2013

Throughout the aftermath of your own overall economy, family property values denied significantly in a lot of places. In response, of a lot loan providers suspended family security personal lines of credit (HELOCs) otherwise reduced borrowing from the bank limitations, creating conformity and you can reasonable credit dangers. If you’re houses costs possess rebounded on the downs of one’s crisis, loan providers need to nevertheless be aware of the debt below Controls Z when a life threatening reduction in an effective property’s worthy of you to acceptance a beneficial creditor when deciding to take this type of tips might have been recovered. Creditors might also want to accept the fresh new fair lending chance of the this type of methods. This article will bring an overview of the brand new compliance requirements and you may risks whenever a collector requires step on a good HELOC because of a beneficial change in worth of. step 1

Control Z Compliance Conditions

Part of Regulation Z imposes significant compliance conditions towards HELOC creditors. That it area not just need revelation off bundle conditions and terms as well as fundamentally prohibits a creditor from switching all of them, except for the specified situations. One to condition enabling my explanation a collector in order to suspend good HELOC otherwise lose its borrowing limit occurs when the property securing the brand new HELOC skills a life threatening lowering of really worth, because provided during the 12 C.F.Roentgen. (f)(3)(vi)(A):

No creditor will get, by the price otherwise … transform one title, except that a creditor may… prohibit more extensions away from credit or reduce the credit limit relevant so you can an agreement throughout the any months where property value the structure that secures the program refuses somewhat beneath the dwelling’s appraised worthy of getting purposes of the master plan. 2 (Emphasis additional.)

This new controls doesn’t establish a great significant decline. But not, Feedback (f)(3)(vi)-6 of your own Official Professionals Opinions (Commentary) provides creditors having a safe harbor: Should your difference between the initial credit limit while the readily available equity are shorter in half due to a value of decline, the refuse is regarded as tall, permitting creditors so you can refute more borrowing from the bank extensions otherwise reduce the borrowing limit for a HELOC bundle.

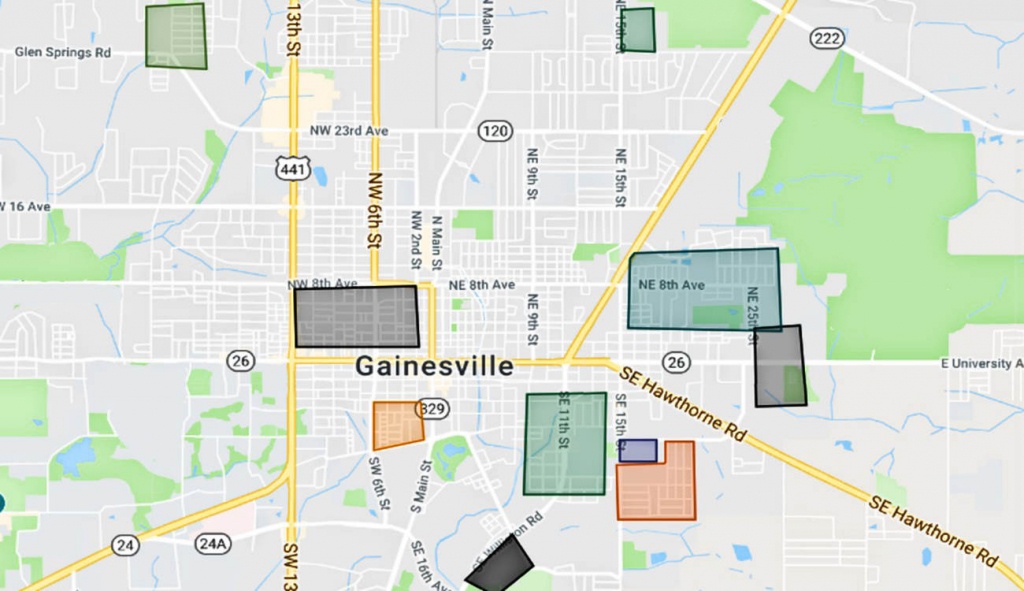

When deciding if a significant decrease in really worth has occurred, financial institutions is always to contrast the fresh new dwelling’s appraised value during the origination up against the current appraised value. Brand new dining table below will bring a good example. 3

Contained in this analogy, the fresh collector you can expect to prohibit then advances otherwise slow down the credit limit if your worth of the home refuses away from $100,000 so you’re able to $ninety,000. Administration will be mindful one to even though they is allowed to slow down the borrowing limit, new avoidance can not be beneath the level of the an excellent balance if the doing so would require an individual and also make increased percentage. 4

Value of Measures

The latest creditor is not needed to find an assessment ahead of cutting or freezing an excellent HELOC in the event the domestic well worth provides fell. 5 Yet not, having examination and you can recordkeeping objectives, brand new creditor is to retain the paperwork upon which it depended to introduce one a critical reduction in property value taken place prior to taking step into HELOC.

In , new Interagency Credit Chance Management Pointers to possess Family Security Credit is actually composed, which has a dialogue off guarantee valuation administration. 6 The brand new recommendations provides types of exposure government practices to adopt while using the automated valuation models (AVMs) otherwise tax evaluation valuations (TAVs). Next tips about appropriate strategies for using AVMs or TAVs are provided from the Interagency Assessment and you may Evaluation Guidelines. eight Administration may want to consider the recommendations when using AVMs otherwise TAVs to choose if or not a life threatening refuse has actually took place.

Including regulatory compliance, associations should be aware one to a good amount of category step serves were filed challenging the effective use of AVMs to reduce borrowing from the bank limitations otherwise suspend HELOCs. 8 This new plaintiffs in these instances has actually challenged individuals aspects of compliance, for instance the use of geographical place, rather than personal property valuation, since a foundation having a great lender’s looking for away from loss of worth; the AVM’s reliability; plus the reasonableness of your appeals processes in position in which a debtor may difficulty brand new reduced amount of the latest personal line of credit. Into the white associated with the litigation exposure, it is essential getting organizations to invest attention in order to conformity criteria.