While a centralized engine is prone to attacks as a outcome of its reliance on a central server, a decentralized engine, working on a distributed network, presents more resilience against potential breaches. Transparency of buying and selling – A match system improves transparency within the monetary market by providing equal entry to purchase and promote order knowledge, resulting in extra accurate worth determination. The First-In-First-Out (FIFO) algorithm, also called the Price-Time algorithm, gives precedence to purchase orders based mostly on price and time. The match engine employs algorithms to fulfil orders based mostly on parameters like worth, quantity, and time of order entry. Matching software is important for buying and selling venues to execute incoming market orders with liquidity from restrict orders within the order guide.

Every time a trade is made, the balance between the most effective obtainable buy/sell costs and volumes thereof is altered as liquidity is removed, thus setting a brand new prevailing market value. This is what market members mean when they discuss value discovery. Centralized engines usually have greater charges than decentralized engines. This is as a end result of they require extra infrastructure and sources to function.

This means there isn’t a central point of failure, and the system is more resilient to assaults. According to our values, acquiring a maximum commerce execution doesn’t should lead to irrelevant practices and inequitable prioritization. Therefore, we work hard to supply a robust and truthful trading platform that displays our values. The matching engine algorithm will create a balanced setting by leveraging varied standards similar to time, worth and volume. We believe that is crucial so as to construct a framework that can attract traders with rational behaviors who want to commerce efficiently.

Overview Of Vertex Ai Vector Search

Imagine it because the matchmaker of the buying and selling world, pairing those trying to purchase with those able to sell, and vice versa. Its primary mission is to execute trades swiftly and efficiently, creating a stage taking part in subject for market participants. This engine is designed to match orders from multiple users in real-time, nevertheless it doesn’t rely on a central server.

- The requests might succeed or fail relying on previous trades executed towards the order.

- It prioritizes orders primarily based on price first after which by the point of order submission.

- Connect and share data inside a single location that is structured and straightforward to look.

- One attainable use case for Vector Search is an internet retailer who

On the other hand, a decentralized engine will be the better option if you need resilience and safety. As we proceed to evolve and grow, more and more gifted persons are joining the LGO household. We have lately taken on Arnaud Lemaire as our Head of Research Development. He brings an in-depth knowledge of blockchain technologies and prioritizes commerce processing and optimization on the change, which has been integral through the growth of our matching engine. The ability to course of orders quickly is essential, especially in a landscape the place each millisecond counts.

Why Matching Engines Matter

With predefined algorithms dictating order priority, matching engines uphold equity, promoting transparency in commerce execution. Traders can belief that their orders are processed impartially based on established rules. It ensures that trades are executed pretty and efficiently by adhering to predetermined rules, which purpose to ensure the most effective execution attainable for all market participants.

If the results aren’t accurate sufficient, you modify the parameters of the algorithm or allow scaling to help more queries per second. This is finished by updating your configuration file, which configures your index. That’s why we’re thrilled to introduce Vertex Matching Engine, a blazingly fast, massively scalable and absolutely managed resolution for vector similarity search.

Matching orders refers to the process by which purchase and promote orders for a particular security are paired in a buying and selling system. This system is usually managed by a inventory trade or a matching engine in an digital buying and selling platform. In the past, trading and order matching were heavily based mostly on telephone calls and guide processes. Such systems have been significantly extra time-consuming and susceptible to human error when in comparability with the sophisticated matching engine systems we use today.

This eliminates a single level of failure and will increase security in opposition to assaults. Order matching is integral to the worth discovery process in financial markets. As buy and promote orders are matched, the agreed-upon costs turn into the new market costs for the respective securities.

Risks And Challenges So As Matching

The articles and research support supplies available on this web site are educational and aren’t supposed to be funding or tax recommendation. All such info is supplied solely for convenience purposes only and all users thereof should be guided accordingly. There are also rules https://www.xcritical.com/ towards manipulative practices like spoofing, where traders place orders with the intention of canceling them to govern costs. A market order is a type of order the place an investor decides to purchase or sell a safety at the best obtainable worth within the current market.

DXmatch is Devexperts’ proprietary order matching engine designed for ultra-low latency and high throughput applications. It is trusted by regulated securities exchanges, dark swimming pools, cryptocurrency exchanges, and OTC venues worldwide. A robust trading platform is constructed round an efficient orders allocation algorithm also called an identical engine. Because this algorithm functions because the core of any trade, we want to develop one that matches and upholds our values.

By default, an identical engine will always try to discover one of the best value available (2) for a given order (1). Security – Select a safe match engine with a built-in remote password protocol to guard your software program from attacks. Exchanges and marketplaces present a venue for market players to swap shares, digital currencies, commodities, and different investment options. They purpose to create an equal and structured buying and selling expertise for everybody involved.

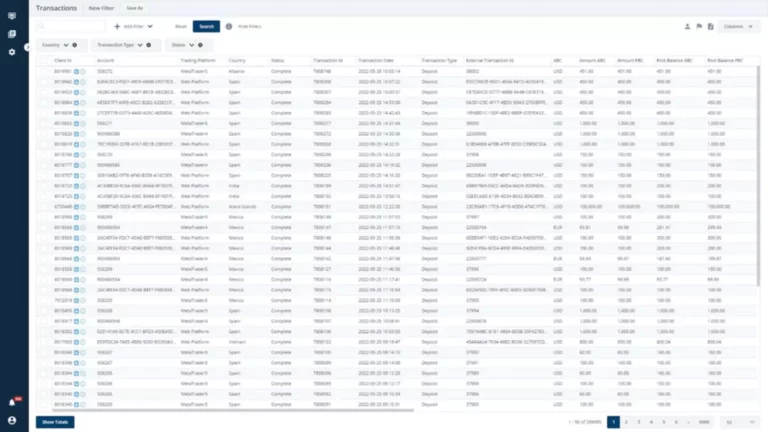

Traders enter their intentions to purchase or promote, recording them in the order guide. This is where the matching engine steps in, analyzing the panorama and connecting appropriate orders. Order administration – A trading match engine aids so as management by offering varied tools, processes, and algorithms for efficient order administration exchange matching engine. OMEs are crucial in electronic buying and selling systems, enabling market members to trade with out human assistance and offering numerous advantages. These engines assist in linking purchasers with sellers and promote trades by evaluating their orders to search out perfect matches.

Choosing The Right Matching Engine

The article will define matching engines’ performance benefits and disadvantages. A vibrant and efficient order-matching system ensures that there are sufficient purchase and promote orders at any given time, contributing to a liquid market. Without a matching engine, the process of finding a counterparty for every commerce could be considerably slower and less efficient. The Market Data Feed service presents the flexibility to receive real-time updates in regards to the trading info such as quotes, final traded price, volumes and others. Common usages of this API embody web-based buying and selling techniques (widgets like Watchlist or Market Depth) and public web sites. DXmatch is a modular platform outfitted with superior danger administration options.

The trading engine is a posh, refined piece of software program that collects and instantly synchronises information from completely different currencies being traded. Finance exchanges typically place orders by way of a member broker for execution at one of the best worth. A financial professional will supply guidance based on the knowledge offered and offer a no-obligation call to raised perceive your situation. Finance Strategists has an promoting relationship with some of the corporations included on this web site. We may earn a commission when you click on on a link or make a purchase via the hyperlinks on our web site.

Please follow the instructions on the boost website for building/installing the library in your environment. When you’re carried out you must export the $BOOST_ROOT surroundings varialble. To build the Liquibook take a look at and instance programs from source you need to create makefiles (for linux, et al.) or Project and Solution files for Windows Visual Studio. Find out if a potential supplier can supply these, or whether they have a roadmap in place for including this performance at a later date. After you may have the approximate nearest neighbor results, you can evaluate them to see how nicely they meet your wants.

This flexibility permits buying and selling venues to determine on the deployment possibility that most precisely fits their needs and infrastructure. Ensure that the matching engine supplies user-friendly administration software for monitoring and intervention. This software program ought to allow simple visualization of actions on the trade and embody controls like a kill change to cancel orders or mass cancel options. On the opposite aspect of the spectrum, we now have venues such as cryptocurrency exchanges, which are far much less involved with latency. These venues are overwhelmingly utilized by retail shoppers, so the allowances for this sort of buying and selling venue are radically completely different from the HFT instance above.