Whenever you are student loans is a useful unit to own investing in college or university in the usa, they’re able to end up being a primary financial load when you graduate. When you’re willing to have that month-to-month education loan fee aside of your life, there are ways to repay student loans quicker.

Increasing your debt installment might not be effortless, but it could well be really worth the sacrifices in the long run when the you can get rid of your student education loans prior to plan.

When you are curious just how to pay back student education loans timely because a worldwide beginner, below are a few actions that’ll assist:

step one. Refinance having a lower interest rate

If you’re looking to settle your own college loans less, you can thought refinancing your around the globe figuratively speaking having a loan provider based in the United states. For many who refinance education loan personal debt, you could potentially score a lowered interest.

Because less of your money could well be planning to attention, you’re able to pay for extra payments in your refinanced mortgage. Of numerous refinancing lenders on the You.S. dont charges a good prepayment punishment, and that means you will most likely not have to worry about accumulating any prepayment costs either.

Specific lenders provide even more price deals if you make towards the-day money otherwise create automatic repayments. MPOWER Financing , for example, even offers a 0.50% rate slashed for folks who place your refinanced student loan towards the autopay and you may a supplementary 0.50% speed disregard once you’ve produced half dozen successive costs playing with autopay.

Taking such procedures to reduce their rate of interest up to it is possible to may help create your financing less costly because you works to expend it well reduced.

dos. Spend over the minimum payment

When you use a student loan, you usually commit to pay it back which have fixed monthly obligations more a specific amount of age. But when you shell out more the minimum matter due for every month, you might shave days if not ages off their fees name.

For example, imagine if loans Rockvale CO you grabbed an effective $thirty-five,000 loan in the a good % speed. For those who pay $463 a month, you’ll get rid of that debt within the a decade. But if you is also hit the payment per month doing $513 ($fifty significantly more a month), you’ll get out of financial obligation a year and a half reduced and you may rescue nearly $step 3,five hundred inside appeal. If you can spend $563 a month, you will get eliminate your debt a couple of years and you can eight months quicker and rescue nearly $6,100000 when you look at the interest charges.

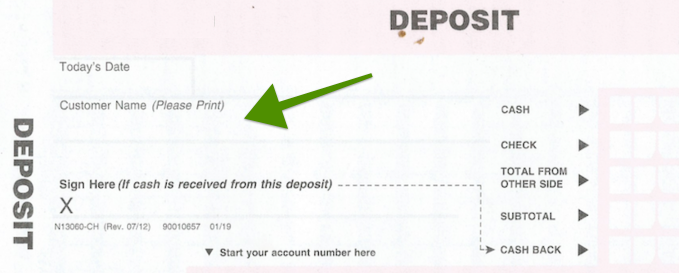

Ahead of setting-up their improved money, it can be worthy of calling the loan servicer in order to make certain that it’s using the repayments accurately. We wish to ensure that your money are getting towards your own dominating harmony unlike getting spared for upcoming bills.

step three. See employment that have education loan advice

Specific companies offer education loan guidance positive points to their workers. Bing, for example, often complement so you’re able to $dos,five hundred inside the education loan money annually because of its personnel. And you will technology business Nvidia pays around $six,100000 per year inside the student loan help with a lives limitation out of $29,000.

If you’re looking having a unique employment, believe prioritizing a company to assist you pay their student loans. Keep in mind that in the world college loans commonly always eligible for so it work for – you might need in order to refinance their student education loans which have good U.S.-centered financial so you’re able to be eligible for company-backed education loan recommendations.

4. Generate biweekly repayments

While making month-to-month student loan payments, consider switching to biweekly costs. This means, split the monthly bill in half and you will pay that matter the two weeks. Unlike investing $200 once per month, like, you might pay $one hundred all 14 days.

Possible still spend the money for same number per month, but due to the calendar works out, you’ll end up and then make the full even more payment on a yearly basis. And work out biweekly money on your student education loans is a simple way to pay off the debt reduced with very little additional effort into the their region.

5. Inquire about an increase or functions a part hustle

And also make most payments in your student education loans would-be difficult when the there is no need people space on your budget. When you are committed to removing the debt prior to schedule, identify an effective way to boost your money.

You could require an increase from your boss or works a side hustle, instance riding to have an experience-revealing service otherwise giving self-employed qualities on the internet. Whenever you can improve earnings, you could use you to definitely additional money into the paying down your own scholar mortgage debt.

six. Reduce your living expenses

And additionally increasing your money, believe ways to decrease your expenses. Releasing right up extra space on your funds will help you manage most money on your student loans.

Imagine downsizing so you can a less expensive flat or transferring having good roomie otherwise two. For many who tend to eat out within dining, was buffet planning and you may cooking at home. And when your car or truck commission are an extend, consider trading on your own vehicle for a less expensive vehicles.

Take a look at their month-to-month expenses to understand places where you could cut back. Also a supplementary $50 or $100 a month may help you pay back their figuratively speaking faster.

7. Set a funds windfall to the your fund

For individuals who discovered an unexpected windfall of money, such as a plus at work or heredity, it could be tempting to pay they towards anything fun. However if you’re committed to reducing their student debt immediately, believe getting that windfall into the their student loans.

If you like a boost of motivation, fool around with a student loan calculator observe how much cash a supplementary fee carry out save you. From the viewing how much cash you could conserve in the attention, as well as the day you could shave off the debt, you can end up being driven to adhere to your debt cost wants.