Exactly who Must look into Integration?

Combination is just be employed for its required purpose – to minimize the quantity of your debt from inside the a controlled ecosystem. It should never be put while the a miracle Record choice to “lift” your personal debt off of the webpage. Thus do not think that you could start accumulating the fresh new expenses.

For those who combine and you spend money like a wasted fool, you could too place a couple oars in your charge card once the you’re paddling into the ideal storm. You’re going to be underwater within just weeks.

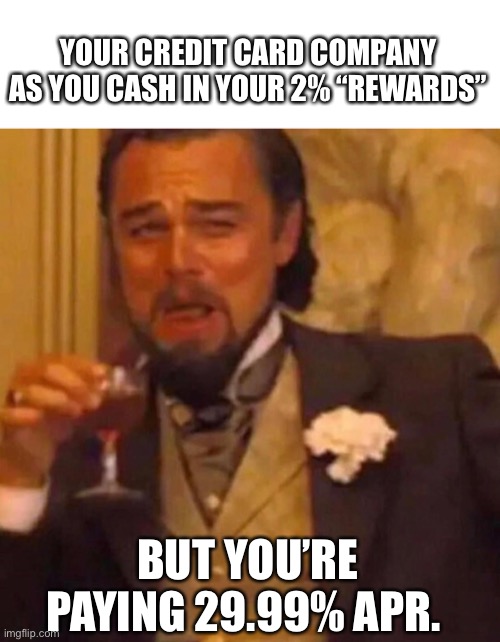

- Right now, you may have large Apr personal debt and also you desires to keeps a lesser rates you to pertains to all of your current loans. Certain credit cards immerse your which have APRs exceeding 25 percent. If you’re in this situation, it’s also possible to soon know seeking reduce towards the a keen extremely high rate was a burning race. Integration is a wonderful choice to protect a diminished Apr.

- You are being strangled by sum of your minimum monthly payments and you will you might enjoy the brand new rescue off lower monthly premiums. People with an abundance of financial obligation normally supply highest minimum monthly premiums, tend to more than they may be able pay for. So it begets a vicious cycle where you initiate destroyed repayments, ultimately causing highest costs and you may painting oneself for the a financial part no refrain. Merging normally lower your lowest monthly payment, which will surely help you stand above-water and watch specific light at the end of the fresh canal.

- Youre overrun from the paperwork and you may bookkeeping you will want to do in order to organize this new onslaught of different expense and comments most of the few days. Let us get a hold of, the car notice and you may insurance rates try owed towards the fourth and new 7th correspondingly, your own Visa statement flow from to your 9th, condominium costs to the 15th, the fresh new power company is cutting off your power for many who don’t spend because of the 17th – or was it the fresh new 7th? It’s easy to rating mislead, especially if you commonly continue due dates in mind. By combining into that invoice, possible explain your lifetime and also are experts in delivering from loans.

What Consolidation Choices are Offered?

There’s absolutely no solitary program or plan having merging obligations. But you’ll find range economic choices to help you slow down the stress on your financial budget and you may category your own obligations together to your you to umbrella commission. Choosing the right choice for just the right reason will make you fiscally responsible and place you on the path to obligations-100 % free versatility; selecting the wrong choice may leave you shirtless.

Debt consolidating Functions

There are a great number of people seeking to keep you afloat, so be sure to contrast all of them top-by-front and you will part-by-section.

A debt consolidation organization pays off all your a great debts, and you will don’t owe your creditors any money. As an alternative, you are going to are obligated to pay one to organization an expense one to equals each of your past debt, which you are able to spend in one simple South Carolina title and loan payment per month. The low the fresh Apr you’ll find because of it alternative, the greater appealing its.

But discover issues and you may downsides so you’re able to simplifying your finances that it means. After you have finalized to the agreement, there is absolutely no backtracking. Obviously, this helpful services is not free. And additionally prominent and you may interest money, you will find fees, that can be eat you alive when you have shorter-than-best credit.

Sometimes it might seem sensible in order to discuss debt settlement on the certain certain costs before offered a greater debt consolidating system.

It’s really no miracle that most people who find themselves awash in debt routinely have bad credit, so high prices and costs is capable of doing them within the reduced.