Wanting a house is actually an exciting but nerve-wracking procedure. There’s absolutely no informing the length of time your quest might take or whenever and in which discover a property you to clicks their packages.

After you have found the ideal family, there is nevertheless the problem out of funding. Delivering pre-accepted to have home financing can present you with significantly more trustworthiness since the a buyer if you’re reassuring providers and you can intermediaries that you’re planning contain the expected finance once they undertake their promote. Of the investing in an offer Buying and having it approved, possible still have to provide the seller which have proof finance (put simply actual acceptance getting a home loan) from the a certain go out, or the bring usually lapse.

Whilst it does not make certain the bond software could be accepted, it can make you a good manifestation of what you could manage. This can help you improve your residence look and feature suppliers otherwise agencies that your particular to buy stamina is far more likely to results for the a bond approval. Here’s what you should know on taking a thread pre-investigations.

What is bond pre-recognition?

We believe in a thread to invest in their house, whatever the they earn or perhaps the property’s well worth. Few of you feel the sort of money expected to purchase a property downright in the place of financial assistance. The worth of the bond your be eligible for depends toward many things, as well as your financial history and you may income. Many people hold back until he’s got discover property they want to invest in before applying for a thread. Just like the various other lenders assess cost differently, it is difficult to assume in the event your software might possibly be accepted before you make it.

Taking a bond pre-acceptance relates to dealing with a lender to produce an estimate from what you are able manage. As you can accomplish that prior to starting domestic hunting, it offers a budget you might be eligible for – however, would not make certain any ensuing thread programs will result in acceptance.

How to get pre-qualified for a thread

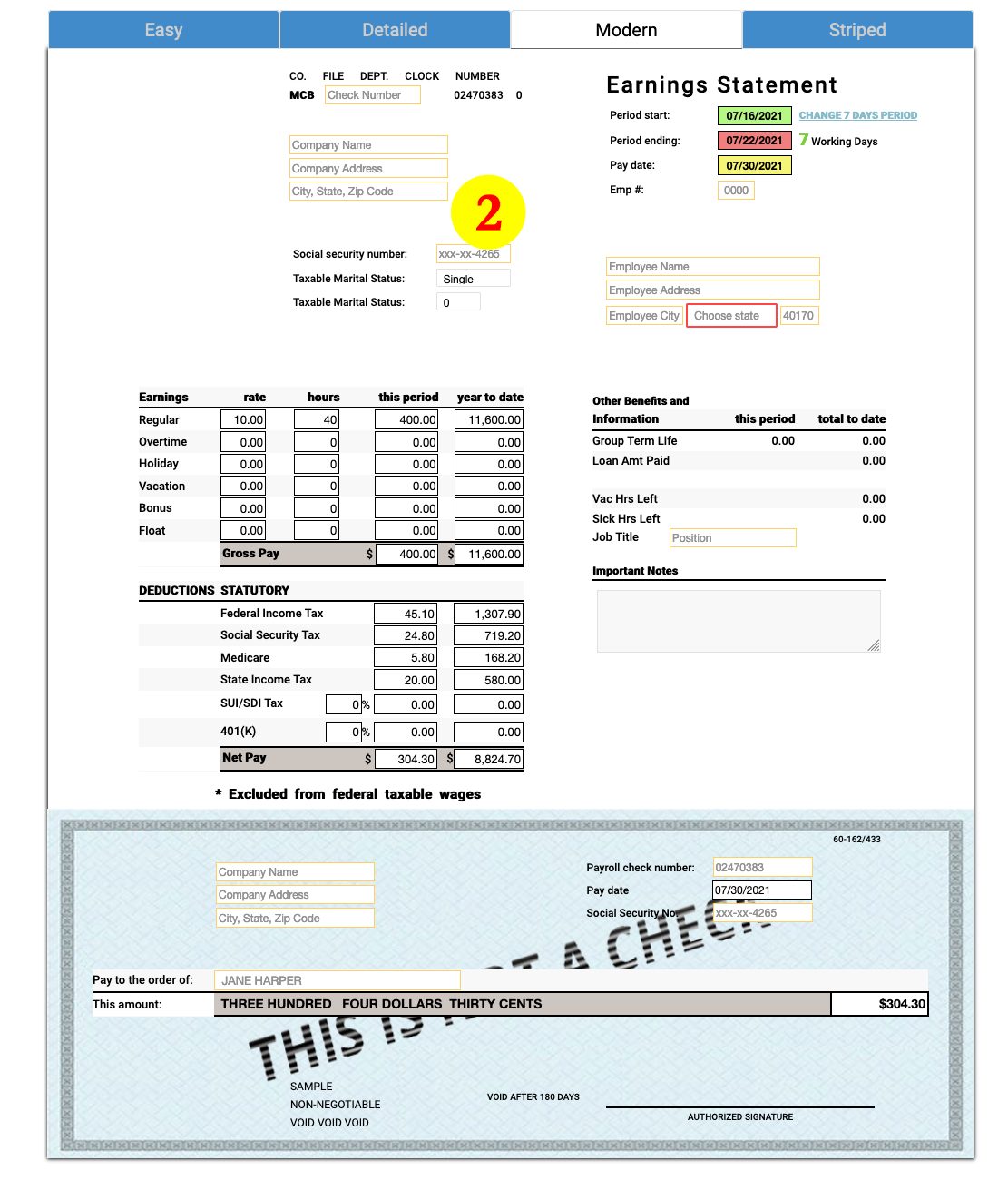

There is no you to-size-fits-all of the pre-app procedure. Usually, the more particular advice you give a lender with, the greater number of sensible your own pre-acceptance is additionally the likely to be it might be in order to produce real recognition. You’ll want to submit a selection of right up-to-time economic data to show you constantly discovered a certain earnings and can manage to make monthly bond money while nevertheless including to be able to satisfy your almost every other month-to-month living expenses. Loan providers can also look at your financial behaviour and you may credit installment history to find out if you may have numerous personal lines of credit and you can have monitoring of honouring your own commission financial obligation.

- They suggests you will be a serious visitors: Anybody commonly get in touch with suppliers and estate agents otherwise sit-in discover homes and viewings from interest – with no intention of and make an offer. Being pre-accepted will make you more attractive in order to supplier and you may agents because the it means you may be significant.

- They shows you how to change: Their pre-approval matter might possibly be less than asked, definition you would not be eligible for the sort of land you will be interested within the instead of and come up with changes. You need to use this post so you can review your money otherwise adjust your traditional. Eg, you might intend to invest an extra year rescuing doing enhance your deposit amount you can also have a look at residential property for the a cheaper urban area.

- You possibly can make alot more experienced choices:To buy property can come with many more will cost you you did not think. For example judge and you can administrative fees, moving costs and you may repair costs. Being aware what you be eligible for makes it possible to assess for folks who are designed for handing over more cash in the end. Such as for instance, you can realise you to definitely when you are their pre-recognition count is reasonable, to purchase a beneficial fixer-top demanding thorough fixes might be from your budget into the tomorrow.

Ways to get your pre-analysis certificate

Understanding the difference in pre-recognition and you can genuine acceptance might be difficult given that particular home buyers aren’t regularly the newest words otherwise don’t understand the procedure. To simplify the method and also make some thing easier for all of our subscribers, SA Home loans will allow you to see good pre-assessment certificate you can use of your house hunting procedure.

To be certain this pre-research is as appropriate you could, do not promote an automated on the internet software processes. Alternatively, might package physically with our professional possessions finance professionals to accomplish new pre-evaluation. This gives the opportunity to ask questions about the procedure also to feel guided on the financial situation, what you could afford and how to improve your likelihood of approval.

Once you have given the brand new associate with a complete and you can appropriate information of your own income and you can expenditures, they’ll focus on a credit assessment (along with your consent) to assess the borrowing from the bank reputation and you can cost. It will help them build an excellent pre-assessment certificate for you, in order to begin searching for suitable home.

When you see a property you want to installed an enthusiastic provide toward, your own agent commonly over a proper app, a valuation of the property we want to get could well be over, plus money and expenses would-be affirmed before your home mortgage is approved. When your monetary info is exact and you may hasn’t significantly changed between trying to get good pre-assessment certificate and you can obtaining a thread, the probability of becoming refuted with the bond might possibly be paid down.

Communicate with SA Lenders today

We would love to assist you in ensuring that you could feel the confidence to start your house purchasing trip, having a great pre-acceptance to convey the buying power you would like. To find out how to begin, call us today.